The Government has laid final regulations which introduce transfer conditions from 30 November 2021, one of which must be satisfied before a pension scheme, such as Associated British Foods Pension Scheme, can make a statutory transfer on behalf of a member.

Under these provisions, members requesting a transfer will need to provide the Scheme Trustee with additional information aimed at proving that the receiving scheme and their relationship with it is genuine and the decision to make a transfer is properly informed.

Background Information

Based on reports to Action Fraud, over £30 million was lost to pension scams between 2017 and August 2020. Given the scale of the problem, which is likely getting worse as scammers adopt increasingly sophisticated tactics, the Government has responded by introducing these new measures which are designed to empower trustees and pension providers to prevent transfers to potential scam arrangements. The measures aim to strike a balance between providing greater protection for pension savers, while continuing to give them the right to exercise choice over how they use their pension savings.

Conditions

Under the regulations laid by the Government, a statutory transfer will only be allowed to take place from the Scheme where one of the following two conditions is met. If we have not received all of the required forms, documents and confirmations from the member and their chosen receiving scheme (and their financial adviser, where applicable) within three months of the guarantee date of the Cash Equivalent Transfer Value quote that we provide to the member and if the scams checking process (including the member receiving guidance from MoneyHelper if required) has not been completed within six months of the CETV guarantee date, the member may be required to make a new transfer request and complete the full process again if they still wish to transfer. This may affect the amount of the transfer value.

Condition 1

The first condition will be met where a transfer is to:

- a public service pension scheme as defined in section 1(1) Pension Schemes Act 1993

- an authorised master trust which appears on the Pensions Regulator’s list of authorised schemes, or

- a collective money purchase scheme authorised by the Pensions Regulator.

Before the Scheme can make such a transfer, the Trustees will need to satisfy themselves beyond reasonable doubt that the receiving scheme is established in accordance with the relevant legislation or listed as being authorised by the Pensions Regulator.

Condition 2

Condition 2 is made up of several elements.

A) Employment or residency link

Where a transfer is to an occupational pension scheme not covered by Condition 1, the transferring scheme is required to request information from the member to demonstrate an ’employment link’.

Where a transfer is to a qualifying recognised overseas pension scheme (QROPS), the transferring scheme is required to request information from the member to demonstrate either:

- an employment link, or

- a ‘residency link’.

For this reason, the transferring scheme (the Scheme) will be required to request prescribed evidence from a member to establish whether an employment or a residency link exists. To mitigate the risk that this evidence could be falsified, the Scheme will be required to obtain this information directly from the member.

Where a member fails to provide evidence of an employment or a residency link within a prescribed period following a request from the Scheme (and a reminder), this will be a red flag and the transfer will not proceed.

Where a response to a request for information is incomplete or where the Trustee of the Scheme has concerns that the evidence provided may not be genuine or may not have been provided directly by the member, this will be an amber flag.

B) Any red or amber flags?

Where a transfer is being made to any type of pension scheme not covered by condition 1, including most occupational pension schemes, personal pension plans, group personal pension plans, self-invested personal pension plan and QROPS arrangements, the Scheme is required to request sufficient information from the member to establish whether any red or amber flags are present in addition to any information that is needed to establish an employment or residency link where this is relevant.

In the presence of one or more red flags, a transfer will not take place (even if an employment or residency link exists) and the individual loses their right to take a statutory transfer in relation to that request.

In the presence of one or more amber flags, the member is required to receive specialist scams guidance from the MoneyHelper, via the website www.moneyhelper.org.uk/pension-safeguarding or over the phone on 0800 015 4906 before the transfer can take place (even if an employment or residency link exists). This guidance is designed to alert members to the risks of pension scams and the warning signs to look out for.

Any requirement to receive specialist pension scams guidance would still apply even if the member has already accessed Pension Wise guidance to help with understanding their pension choices through MoneyHelper.

Once the member has participated in a guidance session, the member will be able proceed with their transfer request provided they have supplied the Scheme with a unique identifier provided to them by MoneyHelper. This unique identifier confirms that they have attended a scams guidance session.

What are red flags?

In addition, to the red flags that may arise where the member fails to provide evidence of an employment or residency link upon request, a red flag will also be present in respect of a transfer where the Trustees of the Scheme decide that:

- the member has failed to provide a substantive response to a request for evidence or information

- a person without the appropriate regulatory status has carried on a regulated activity for the member in respect of the transfer in breach of section 19 (the general prohibition) or section 20 (authorised persons acting without permission) of the Financial Services and Markets Act 2000

- the member’s request to make the transfer has been made further to unsolicited contact for the purpose of direct marketing of the transfer

- the member has been offered an incentive to make the transfer (such as a free pension review, early access to some or all of their pension savings before normal pension age, a savings advance or cashback),

- the member has been, or considers that they have felt, pressured to make the transfer, and/or

- a member fails to provide evidence that they have received specialist scams guidance, where they are required to do so.

The Scheme administrator is required to consider carefully the information provided when deciding whether a red flag is present.

What are amber flags?

In addition to the amber flag that may arise where the Scheme has concerns about the veracity of evidence provided to establish an employment or a residency link (or whether such evidence has been provided by the member), an amber flag will also be present where the Trustees of the Scheme decide that:

- the member has provided an incomplete response to a request for evidence or information

- all of the evidence required to demonstrate the employment or residency link has been provided but it does not demonstrate that the relevant link exists (for example, in relation to the employment link, because an individual’s earnings are below the Lower Earnings Limit)

- there are high risk or unregulated investments included in the receiving scheme

- the fees being charged by the receiving scheme are high or unclear

- the proposed investment structures in the receiving scheme are unclear, complex, or unorthodox

- there are any overseas investments in the receiving scheme, and/or

- there has been a sharp or unusual rise in the volume of requests to make a transfer from the transferring scheme, either to the same receiving scheme or involving the same adviser or firm of advisers (or both).

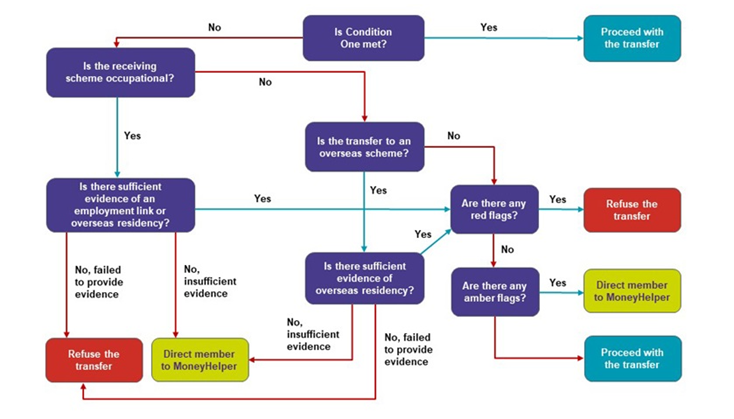

Please refer to the diagram below (which has been provided by The Pensions Regulator) for more information on how red/amber flags are determined: